Taxes in the Netherlands

The Dutch government aims to create an attractive environment and welcomes knowledge workers and talent from abroad. The Netherlands is on the international list of most attractive countries to do business with. However, administrative hurdles and bureaucracy need to be targeted to make access to our country a reality.

We explore in this section

Dutch Tax system

If you live in the Netherlands you are required to pay taxes when you earn money.

The Dutch tax office (called Belastingdienst) collects through various different ways taxes for example Payroll tax and VAT.

You should file the annual income tax return to the Dutch tax office is from 1 March until 30 April. In the page Dutch Tax System we provide more details.

What is the 30 percent tax rule in the Netherlands?

Foreign employees hired by a Dutch employer can be entitled to the so called 30% tax ruling. This means that 30% of the gross income is being paid without any taxes withheld on that part. This is results in a much higher nett spendable income.

The application for the 30% rule must be made within 4 months after starting in the job. If the application is made after the four months period the ruling can only be granted from the next month after the application. This longer period is then deducted from the maximum period of 8 years. Read more in 30 percent tax rule section.

Does the Netherlands have income tax?

Yes, you are subjected to pay tax on your income when you live in the Netherlands. Some of your expenditures may be tax-deductible.

For tax purposes, income is divided into three categories (known as boxes).

- Box 1 - Income from work and home ownership

- Box 2 - Financial interests in a company

- Box 3 - Savings and investments.

Read more in our section Income Tax.

Is Netherlands a high tax country?

Ask any Dutch tax payer they will probably answer this question with a big YES. However, the Netherlands is not in the Top 10 Countries with the Highest Personal Income Tax Rates, Highest Corporate Taxes and Highest Sales Taxes. They are not very far behind though.

What is the 183 day rule

When you live in the Netherlands but work abroad a part of the year, the 183-day rule helps you from paying taxes on your salary in two countries and it also determines in what country your salary should get taxed. Read more in the section 183 day rule.

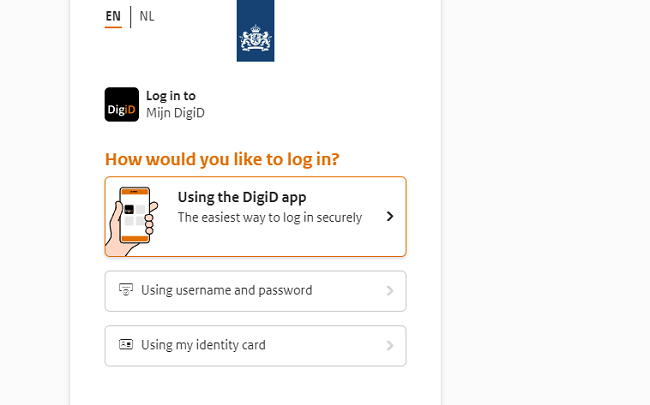

What is a DigiD

DigiD is an online account to identify yourself when you have to arrange matters online regarding the government, your education, healthcare or your pension fund. You can only get one if you have a BSN number. To apply visit the website of DigiD.

Recommended experts

taxt

taxt provides online income tax filing services for individuals in the Netherlands. Our tax experts will handle everything for you. All you need to do is answer a few simple questions, register, upload the requested info and wait for our tax specialists to process your tax return optimally. You can be done with your annual income tax filing in less than 10 minutes. Online. Easy. Affordable.

Suurmond Taxconsultants

Suurmond Taxconsultants is a tax advising company in The Netherlands, near Rotterdam. Don’t miss out on any Dutch tax relief possibilities! Contact our experts now for cutting edge tax advice in international situations.

DTS Duijn's Tax Solutions

The Dutch tax advisors at Duijn’s Tax Solutions have been providing businesses and individuals with Dutch tax advise in The Netherlands for over 15 years. We provide a broad range of Dutch tax consulting services. Through our international tax network of tax advisors, we are able to provide seamless cross border tax advice to over 100 countries.