Taxes in the Netherlands

The Dutch tax system is known for its complexity and broad scope. It encompasses a wide range of taxes, primarily administered by the Belastingdienst (Dutch Tax and Customs Administration). The key types of taxes include income tax, corporate tax, value-added tax (BTW), and social security contributions.

We explore in this section

Income tax

Income tax in the Netherlands is progressive, meaning that the tax rate increases with the amount of income. The system distinguishes between different types of income, which are categorized into three boxes with its own tax rate:

Box 1

Taxable income from work and home, including salaries, business profits, and income from the main residence. As of 2025, the tax rates are:

-

Schijf 1: Till €38.441 - 35,82%.

-

Schijf 2: €38.441 till €76.817 - 37,48%.

-

Schijf 3: From €76.817 - 49,5%.

Box 2

Income from substantial interest in a company, which is taxed at a flat rate of 26.9%.

Box 3

Taxable income from savings and investments, which includes assets such as savings, shares, and property (excluding your main residence). The taxation is based on a deemed return on the value of these assets, rather than the actual income earned from them. This deemed return is taxed at a flat rate of 31%.

Corporate tax

Corporate tax applies to the profits of businesses operating in the Netherlands. The corporate tax rates in 2024 are

- Up to €200,000 of profit: 19%

- Above €200,000 of profit: 25.8%

Value-Added Tax (VAT)

VAT, which is called BTW in Dutch, is a consumption tax levied on the sale of goods and services. The Netherlands has three VAT rates:

- Standard rate: 21%

- Reduced rate: 9% (for essential goods and services such as food, books, and medicines)

- Zero rate: 0% (for some businesses and international transactions)

Social security contributions

Social security contributions are mandatory and fund various social welfare programs including pensions, unemployment benefits (called AOW) and healthcare. Both employers and employees contribute to these programs, with the contributions being automatically deducted from salaries. The exact rates vary depending on the specific program and the employee's income.

Tax filing

Tax returns in the Netherlands are usually filed annually. For individuals, the tax year aligns with the calendar year and the deadline for filing is May. You normally get an invitation to file your income tax. You can choose to do this yourself or hire a tax advisor.

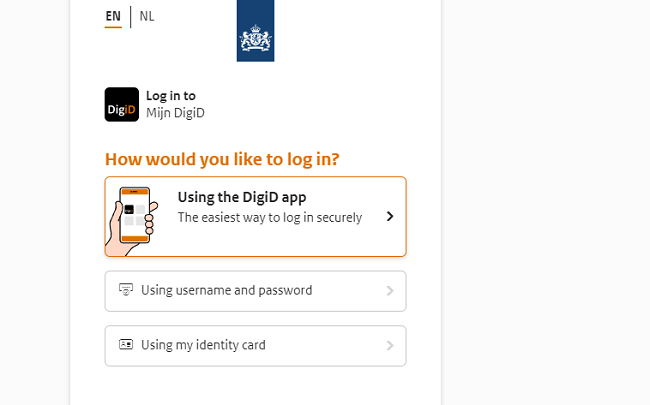

The Dutch Tax and Customs Administration provides an online portal, "Mijn Belastingdienst," where you can file returns, make payments and manage your tax affairs. You will need a DigiD to login to this portal.

Is Netherlands a high tax country?

Ask any Dutch tax payer they will probably answer this question with a big YES. However, the Netherlands is not in the Top 10 Countries with the Highest Personal Income Tax Rates, Highest Corporate Taxes and Highest Sales Taxes. They are not very far behind though.

What is the 183 day rule

When you live in the Netherlands but work abroad a part of the year, the 183-day rule helps you from paying taxes on your salary in two countries and it also determines in what country your salary should get taxed. Read more in the section 183 day rule.

What is a DigiD

DigiD is an online account to identify yourself when you have to arrange matters online regarding the government, your education, healthcare or your pension fund. You can only get one if you have a BSN number. To apply visit the website of DigiD.

What is the 30 percent tax rule in the Netherlands?

Foreign employees hired by a Dutch employer can be entitled to the so called 30% tax ruling. This means that 30% of the gross income is being paid without any taxes withheld on that part. This is results in a much higher nett spendable income.

The application for the 30% rule must be made within 4 months after starting in the job. If the application is made after the four months period the ruling can only be granted from the next month after the application. This longer period is then deducted from the maximum period of 8 years. Read more in 30 percent tax rule section.